Countries which have free trade agreements with the United States, together with Singapore and South Korea, are more secure with respect to Trump’s reciprocal tariff threat, analysts at Nomura stated

The duty of reciprocal tariffs through United States President Donald Trump could end up hurting arising Asia along with India, China and Thailand extra than advanced Asian economies (Hong Kong, Singapore), in step with a note by Nomura.

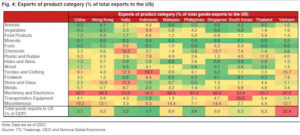

India (9.5% weighted average effective tariff on US exports to India as opposed to a 3% tariff price on India’s exports to the US), Thailand (6.2% opposed to 0.9%) and China (7.1% opposed to 2.9%), Nomura stated, have much better effective tariff rates on the US.

On the other hand, nations that have free trade agreements with US, together with Singapore and South Korea, are secure with respect to Trump’s reciprocal tariff risk, wrote Nomura analysts in a latest note.

Within the Asian economies, India sticks out as having a great higher relative tariff rates, analysts trust, and consequently is uncovered to reciprocal tariffs.

The US account for around 18% of India’s overall exports (around 2.2% of gross domestic product, as of financial 2023-34, i.e. FY24) and is India’s biggest export destination, with the India-US trade surplus uprising in latest years to a high of almost $38 billion in 2024.

Photo Credit: https://www.business-standard.com/

“Key exports include electrical/industrial equipment, gemstones & jewelry, pharmaceuticals, fuels, iron & steel, textiles, motors, apparels, and chemical compounds, amongst others, of which iron & steel and aluminium account for almost 5.5% of the overall,” wrote analysts at Nomura led by Sonal Varma, their chief economist.

Stock markets react to Trump tariff risk

On their part, equity markets back home were cognizant of these revolution – across with tepid corporate income growth for the December 2024 quarter (Q3FY25) – and had been unpredictable with a poor bias for maximum part of calendar year 2025 (CY25).

The Nifty 50 index has fell over 1% of some distance in CY25, with the Nifty Midcap 100 and Nifty Smallcap a 100 indices losing over 8% and 11%, respectively throughout this period.

Events in latest days, according to Christopher Wood, global head of equity approach at Jefferies, have approved that what is probably termed as Donald Trump’s tariff tantrums are mainly negotiating tactic.

“The 10 percentage factor hike in US tariffs on imports from China, enforced on Tuesday, appears incredibly modest in comparison with the 60% insecure in the course of the election marketing campaign. I remain to believe that the obvious way for China to oppose this tariff risk is to provide to installation manufacturing in US thereby supplying another “win” for the 47th American president,” Wood stated.

For traders, analysts say, the outcomes are clean and they must support for intense volatility, which is now possible.

The markets, coinciding with Nigel Green, chief executive officer of deVere Group – a worldwide consulting company that has almost $12 billion well worth of resources below control of (AUM), could be thrown into a whirlwind of erratic policy shifts, triggering violent swings throughout stocks, currencies, and bonds.

“The threat of a broader international slowdown is arising, as corporations put off investments amid uncertainty, and client sentiment weakens. We are entering a duration in which political unpredictability will directly impact market movements. Trump’s tariffs are simply the start—this administration will keep weaponizing trade, making it a high-stakes game for investors,” Green suggested.